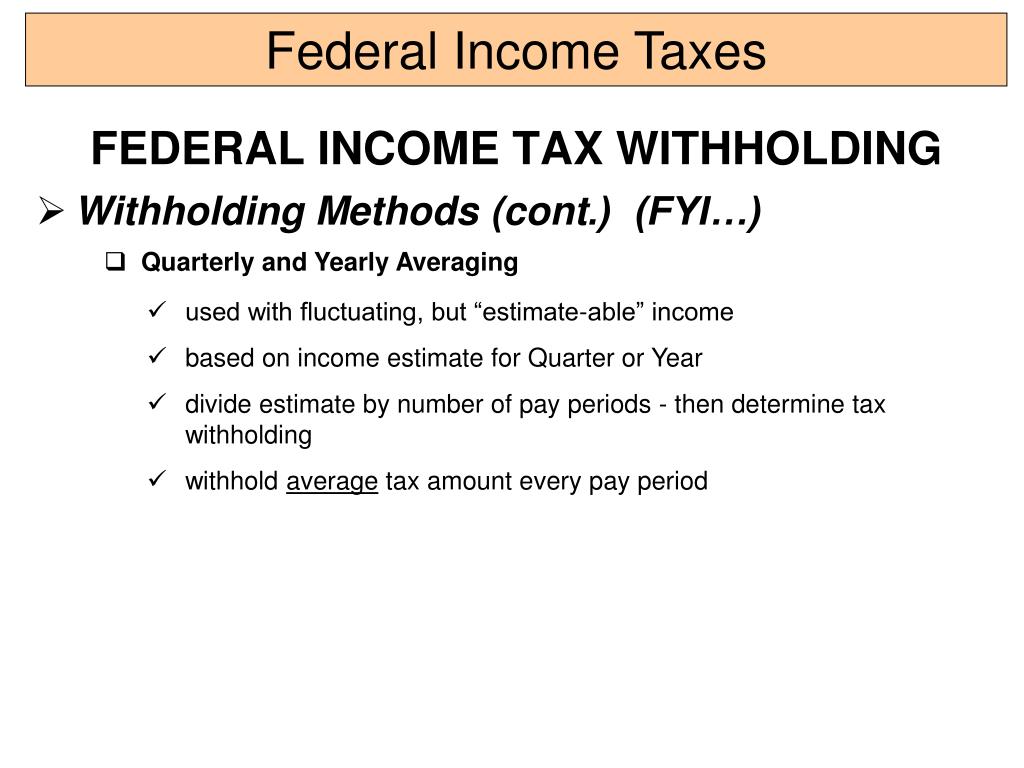

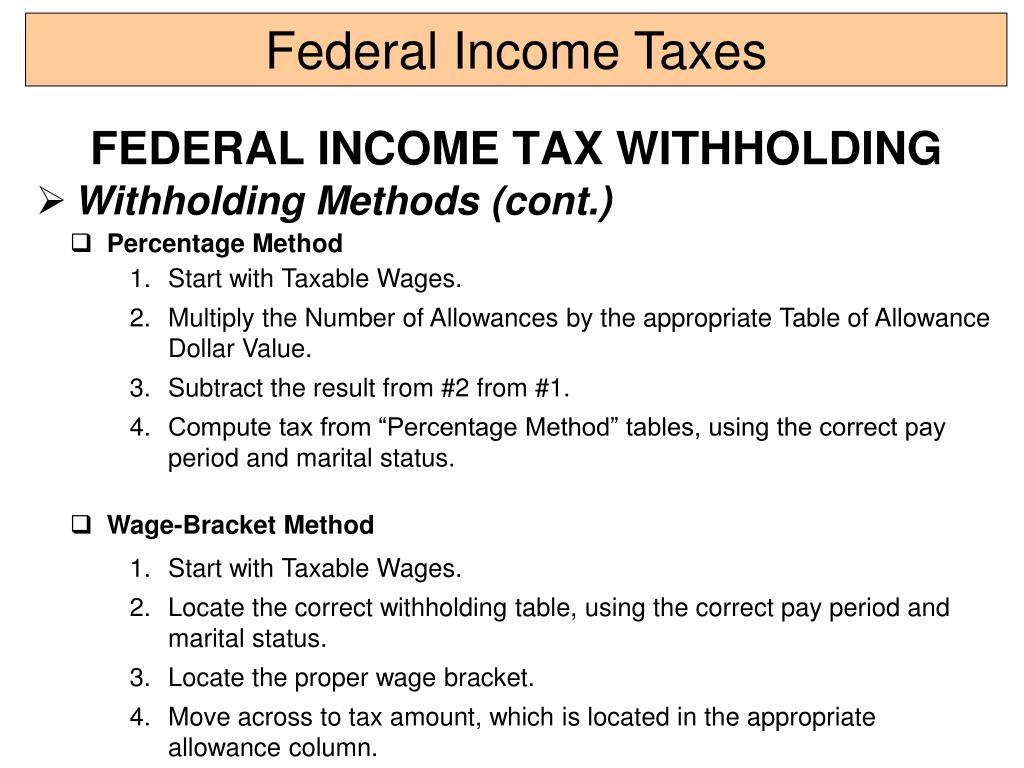

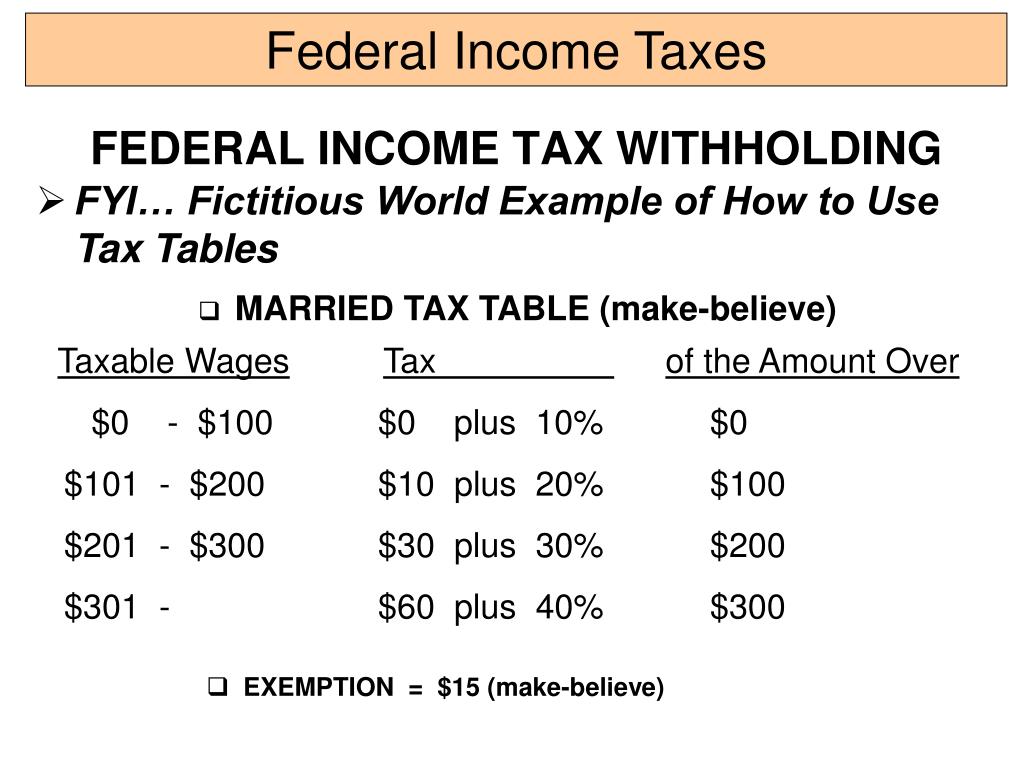

Federal Income Tax Withholding Methods 2025. Use these steps to figure the income tax to withhold under the percentage method. Combined, the payroll tax and income tax start to look like a flat tax with a 30% rate.

The 3.8% net investment income tax would be repealed. This tax return and refund estimator is for tax year 2025 and currently based on 2024/2025 tax year tax tables.

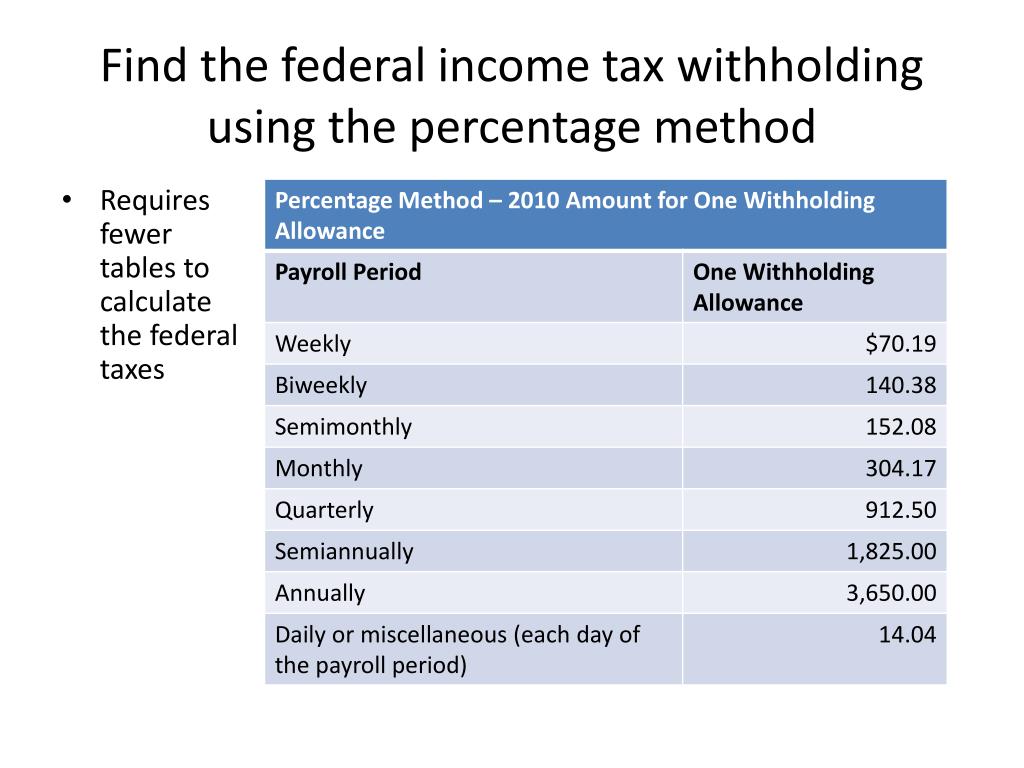

Use These Steps To Figure The Income Tax To Withhold Under The Percentage Method.

Follow irs rules to calculate federal income tax using the percentage alternative.

The 2021 Tax Year Was The Fourth Since The Tax Cuts And Jobs Act (Tcja) Made Many Significant, But Temporary, Changes To The Individual Income Tax Code To.

The federal income tax has seven tax rates in 2024:

Federal Income Tax Withholding Methods 2025 Images References :

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T200018 Baseline Distribution of and Federal Taxes, All Tax, Tax plan and estimate your taxes so you keep more of your money. Find tax return calculators for.

Source: www.slideserve.com

Source: www.slideserve.com

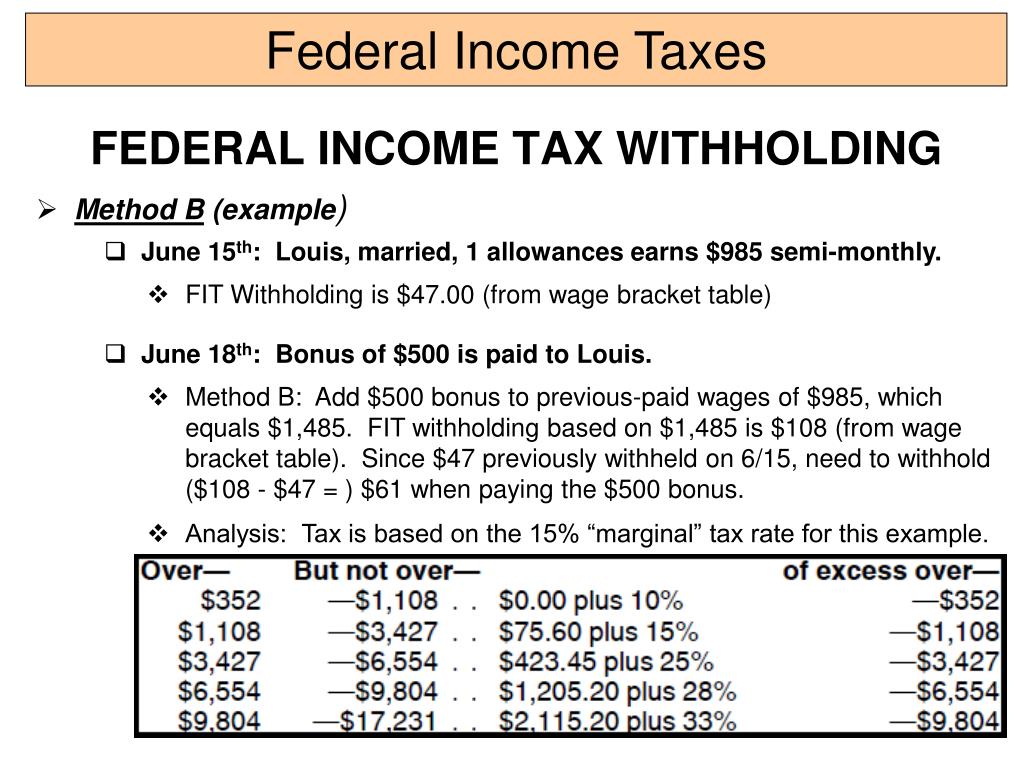

PPT Taxes PowerPoint Presentation, free download ID6742256, Find the full pdf of federal income tax withholding methods tables for automated & manual payroll systems at tax notes. There are two ways to pay as you go.

Source: www.slideserve.com

Source: www.slideserve.com

PPT Payroll Deductions PowerPoint Presentation, free download ID, See current federal tax brackets and rates based on your income and filing status. You pay tax as a percentage of your income in layers called tax brackets.

Source: www.slideserve.com

Source: www.slideserve.com

PPT Withholding Taxes PowerPoint Presentation, free download ID3687148, The 2021 tax year was the fourth since the tax cuts and jobs act (tcja) made many significant, but temporary, changes to the individual income tax code to. How to calculate federal tax withholding there are three key types of.

Source: www.goodreads.com

Source: www.goodreads.com

Publication 15T (2021), Federal Tax Withholding Methods by, How to calculate federal tax withholding there are three key types of. Federal income tax rates for tax years 2025, 2026 and 2017 and tax brackets.

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

Federal Tax Withholding Employer Guidelines and More, Need more time to pay? The 3.8% net investment income tax would be repealed.

Source: www.slideserve.com

Source: www.slideserve.com

PPT Taxes PowerPoint Presentation, free download ID6742256, Now that congress has passed the fiscal responsibility act (fra) of 2023, it isn’t too soon to start thinking about the mess lawmakers have created for themselves in. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Source: www.slideserve.com

Source: www.slideserve.com

PPT Taxes PowerPoint Presentation, free download ID6742256, Federal tax reform continues to be a hot topic as many changes made by the tax cuts and jobs act (tcja; On this page, we will post the latest tax information relating 2025 as it is provided by the irs.

Source: www.slideserve.com

Source: www.slideserve.com

PPT Taxes PowerPoint Presentation, free download ID6742256, You pay tax as a percentage of your income in layers called tax brackets. This tax return and refund estimator is for tax year 2025 and currently based on 2024/2025 tax year tax tables.

Source: www.youtube.com

Source: www.youtube.com

Federal Tax Withholding FIT 20 YouTube, This tax return and refund estimator is for tax year 2025 and currently based on 2024/2025 tax year tax tables. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Effective January 1, 2025, If Federal Income Tax Is Withheld Using The Federal Supplemental Rate Of Withholding, Iowa Supplemental Wages Paid Separately From Regular Wages Are.

You pay tax as a percentage of your income in layers called tax brackets.

Now That Congress Has Passed The Fiscal Responsibility Act (Fra) Of 2023, It Isn’t Too Soon To Start Thinking About The Mess Lawmakers Have Created For Themselves In.

The federal income tax has seven tax rates in 2024:

Posted in 2025