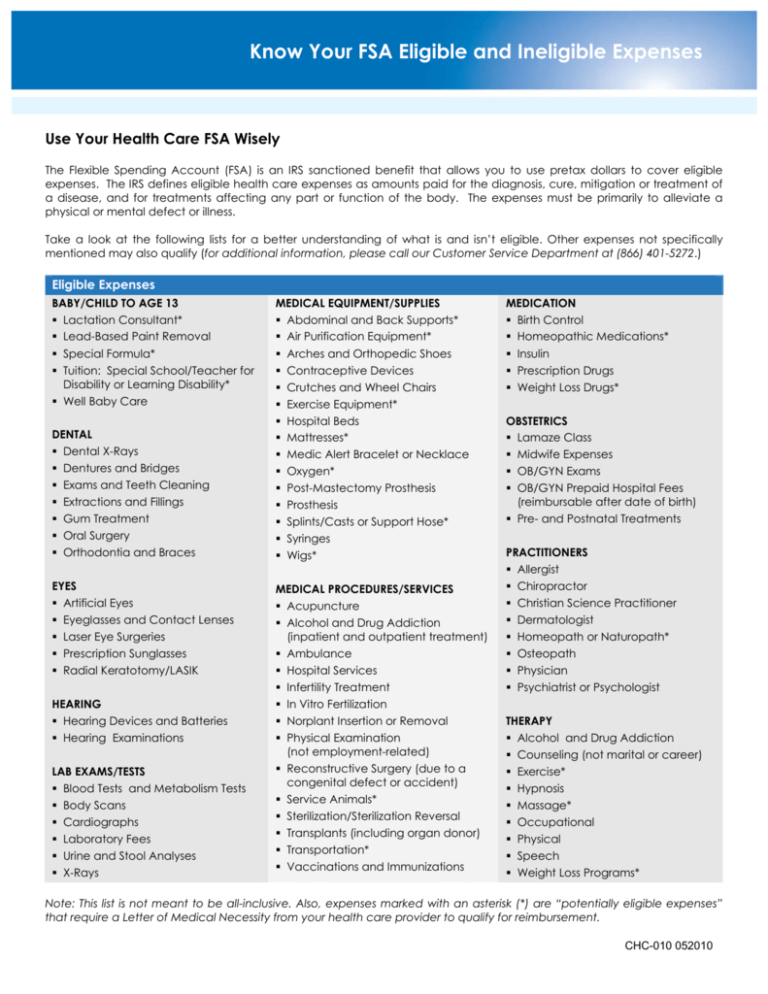

2024 Fsa Rollover Limit In India. The irs set a maximum fsa contribution limit for 2024 at $3,200 per qualified fsa ($150 more than the prior year). In 2024, you can carry over up to $640 (up from $610 in 2023).

Employers can generally allow employees to transfer a. If you don’t use all the funds in your account, you.

2024 Fsa Rollover Limit In India Images References :

Source: aggybzorana.pages.dev

Source: aggybzorana.pages.dev

2024 Fsa Rollover Limit Collie Sharona, — the fsa contribution limits increased from 2023 to 2024.

.png) Source: aggybzorana.pages.dev

Source: aggybzorana.pages.dev

2024 Fsa Rollover Limit Collie Sharona, — for the 2024 plan year, employees can contribute a maximum of $3,200 in salary reductions.

Source: harriondrea.pages.dev

Source: harriondrea.pages.dev

Fsa Rollover Limits 2024 Ketty Merilee, — for the 2024 plan year, employees can contribute a maximum of $3,200 in salary reductions.

Source: sallyannewthea.pages.dev

Source: sallyannewthea.pages.dev

2024 Fsa Rollover Amount Lory Silvia, — from 1 october 2024 onwards, you will earn zero percent rate of interest if you dont meet the criteria mentioned in department of economic affairs guidelines/circular.

Source: danilaqbatsheva.pages.dev

Source: danilaqbatsheva.pages.dev

Fsa 2024 Limits Rollover Denys Felisha, The new limit means married couples can jointly contribute up to $6,400 for their household.

Source: harriondrea.pages.dev

Source: harriondrea.pages.dev

Fsa Rollover Limits 2024 Ketty Merilee, Employers can generally allow employees to transfer a.

Source: bibiyshauna.pages.dev

Source: bibiyshauna.pages.dev

What Is The Maximum Amount For Fsa In 2024 Sydel Ofilia, — the maximum contribution amount has increased to $3,200 and rollover amount is now $640.

Source: roryylorianna.pages.dev

Source: roryylorianna.pages.dev

Limited Purpose Fsa Limits 2024au Ronni Verile, — plans that allow a carryover of unspent fsa funds can now permit up to $640 to rollover in 2024 versus the current maximum of $610.

Source: nadyaqmarijo.pages.dev

Source: nadyaqmarijo.pages.dev

2024 Fsa Hsa Limits Tommi Isabelle, — plans that allow a carryover of unspent fsa funds can now permit up to $640 to rollover in 2024 versus the current maximum of $610.

Source: leodorawallie.pages.dev

Source: leodorawallie.pages.dev

2024 Fsa And Hsa Lim … Romy Vivyan, — an fsa contribution limit is the maximum amount you can set aside annually from your paycheck to fund your fsa.